At Eastman Wealth Strategies, we believe financial planning is about more than charts, returns, or retirement dates.

It’s about people. Families. Legacies. And the quiet confidence that comes from knowing you’ve done what’s right—not just for yourself, but for the generations that follow.

For nearly 50 years, we’ve walked alongside our clients as trusted guides, helping them navigate the complexities of wealth with clarity, humility, and purpose.

You may be a business owner approaching transition, a family preparing for the next stage of life, or a professional seeking peace of mind. Regardless, we’re here to help you make wise, enduring decisions, always rooted in what matters most to you.

Our firm was born out of something more powerful than business strategy—it was born out of a promise.

Early in his career, our founder Earl Eastman met a young couple building their dreams. He encouraged them to protect what they were building with proper planning. But they didn’t see the need.

A short time later, tragedy struck—and everything fell apart. Their story could have ended differently, and Earl never forgot that.

He made a personal commitment: to ensure that no family under his care would ever face that kind of preventable loss. That conviction continues to shape everything we do.

We’re not here to “sell” financial products. We’re here to protect people, create clarity, and build systems that outlive the individuals who create them.

Earl Eastman has spent more than four decades guiding high-net-worth families and professionals through the challenges of saving, growing, and protecting wealth.

His reputation as a thoughtful, strategic, and values-driven advisor has made him a sought-after guide for clients who want more than a generic financial plan.

Earl began his career in traditional financial services, but quickly saw the need for something more personal—something more intentional. That’s why he founded Eastman Wealth Strategies: to offer boutique, highly relational financial guidance built on a foundation of trust, wisdom, and long-term care.

He’s known for his relentless curiosity and commitment to learning. Earl is constantly reading, traveling, attending trainings, and seeking out new strategies that can improve his clients’ lives. But even more, he’s known for how he listens. How he explains. How he shows up year after year for the families he serves.

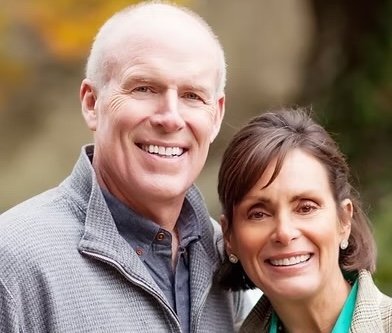

Earl lives in San Diego with his wife of over 40 years, Kimberley. Together, they’ve raised three children and are proud grandparents to four. Outside of work, Earl enjoys model trains, vintage cars, and serving at his local church community.

But his true passion is helping people make smart, confident financial decisions that bring peace, freedom, and lasting impact.

The clients we serve are not defined by a number. They’re defined by intention. They want to be wise stewards of their success. They’re thinking about how to protect their families, how to exit their business well, how to align their money with their values, and how to make the most of what they’ve built.

Some are nearing retirement and want predictable income without market worry. Others are still in the growth phase, looking for smarter tax strategies. Many are thinking about the next generation and how to pass on more than just assets.

Whatever the situation, they all come to us with the same hope: to gain clarity, reduce fear, and take control of their financial future with someone they trust.

That’s what we offer: a long-term relationship rooted in personal care and strategic wisdom.

Most financial firms focus on accumulation. But what happens after the growth phase? What happens when you want to shift from building to protecting? From income to impact?

That’s where we come in.

We help you navigate the crucial transitions in life and wealth: from working years to retirement, from business ownership to exit, from financial independence to legacy.

We focus on things like tax-free income, multi-generational planning, charitable giving, and risk protection. Not just because they’re smart strategies, but because they bring peace of mind and purpose to the planning process.

We believe finishing well means more than just having enough. It means living with confidence and leaving something that lasts.

When you work with Eastman Wealth Strategies, you can expect more than a financial plan. You can expect a relationship.

We start by listening. We want to understand your goals, fears, values, and vision—before we ever talk about numbers. Then we help you build a plan that reflects who you are and what matters most to you.

Once the plan is in place, we stay with you—answering questions, adjusting strategies, coordinating with your CPA or attorney, and checking in to make sure your plan still fits your life.

Our clients often tell us they feel more confident, more informed, and more in control after our conversations. That’s exactly how it should be.

We’ll never push you into decisions. We’ll never speak over your head. And we’ll never treat you like just another account. To us, this is personal.

If you’re looking for a different kind of financial relationship built on trust, education, and long-term care, we invite you to start a conversation.

It doesn’t begin with a pitch. It begins with a question: What matters most to you, and how can we help you protect it?

*Disclaimer: Financial Advisors do not provide specific tax/legal advice and this information should not be considered as such. You should always consult your tax/legal advisor regarding your own specific tax/legal situation. Separate from the financial plan and our role as a financial planner, we may recommend the purchase of specific investment or insurance products or account. These product recommendations are not part of the financial plan and you are under no obligation to follow them. Life insurance products contain fees, such as mortality and expense charges (which may increase over time), and may contain restrictions, such as surrender periods.